Having entered the workforce for the past few years, 2023 is nothing like what I’d imagined my late 20s to be: 5% Fed Interest Rate, PIMCO’s 1.7B Real Estate Default, SVB’s Collapse, and the never-ending layoff…in unit of thousands. And yet, what remains the most confusing, is the consistency in medias as they paint this imaginary wonderland “Meta spiked more than 9% in the after-hour, beating the revenue expectation at 3%”

Incomplete Narratives

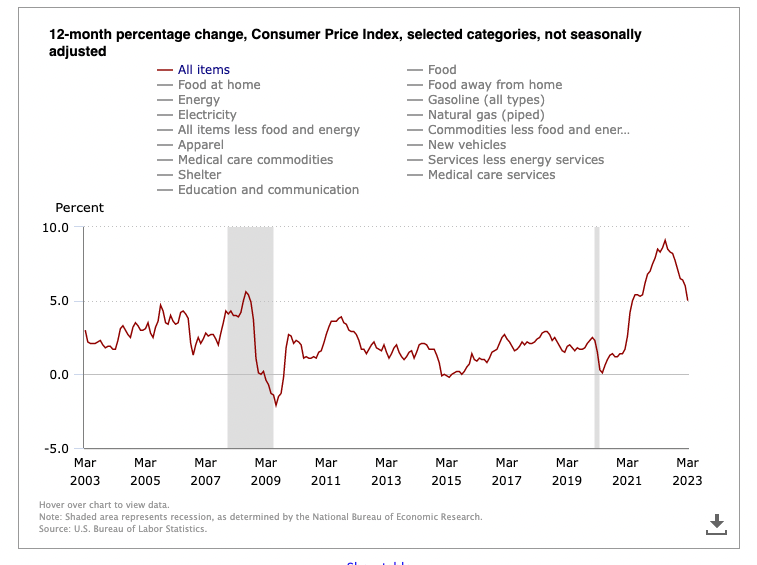

Strangely consistent, that is how stories are painted on the desk of financial media nowadays. Through reading pages of stories repeating over the all mighty strength in consumer/corporate balance sheet. I might have just discovered the golden formula for narrative 2023: “We continue to see strengths on consumer and corporate sector, with CPI at steady level, and “year-to-year growth” at xx%, “beating the wall street expectation by xx%”.

But is that truth?

What we are missing here are the facts hidden underneath these data: Q1 earnings can be easily articulated – with typical seasonal effect, profit margins squeezed out of reduced workforce, and the fact that we just experienced one of the warmest winter in the past 129 years – with January being the 6th warmest, and Feb being the 3rd warmest.

So, what is it that we are actually facing?

“No one can see a bubble; that’s what makes it a bubble.” — Michael Lewis. Big Short

Leverages, but make it for anyone, anywhere

Over the last few months, FED has constructed a market, with excess leverages flooding everywhere, and FED has certainly claimed its influence over this economy. Remaining at low rate for a long period of time, and raising the rate extremely slow – this is the means of FED as it “trains” and reroutes the market completely. It’s now rare and rather strange to see “hedge fund” managers calling for “hedges” on twitters. Managers dropped their economical chart and are now soly focused on predicting the thinking process of one individual mind. Funds are waiting and questioning for when the FED is going to pivot, only to be long even more. And it makes sense, why would they hedge for something that will never happen? Everyone rushed to to be long, and not only long, but also long on leverages.

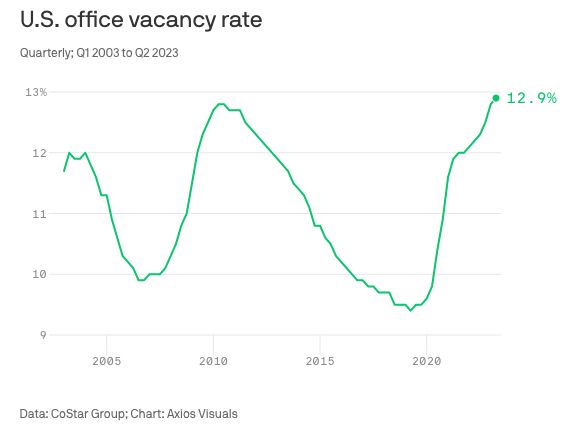

- Tightened Margins: Walking towards vessy street every Wednesday towards my office, I see new skyscrapers growing one after another across the river in jersey city . But it scares me how the world largest financial district is just a ghost town on the nights of Monday and Friday. Who are going to pay for these newly built office? Maybe PIMCO has already told us the answers.

- Millionaire advices from “Tik-Tok Pros”: Online influencers are wiping the internet with real estate advices: persuading young people in their 20s to take out debts and invest in real estate, renting out the properties to pay off monthly mortgage, to gain popularity and followers. If you think you’ve seen it somewheer else you are exactly right, because this is old school in the new school format. And sadly, majority of these viewers are tech workers with their “used -to-be” infinite direct deposite parked in their checking accounts, because why not do something with it?

- Buy now, pay later: Amazon, like many of the players in payments, is releasing “innovative financial solutions” such as buy-now-pay-later, to incentivize spending.

“How do you make poor people feel wealthy when wages are stagnant? You give them cheap loans.” — Big Short

The Hidden Truth

- Finance vs. Economy Divergent: Gold (Candle stick line) diverged from Copper(Yellow Line) since Mid February, outperforming Copper at 14% y-y return, versus copper at -3% return.

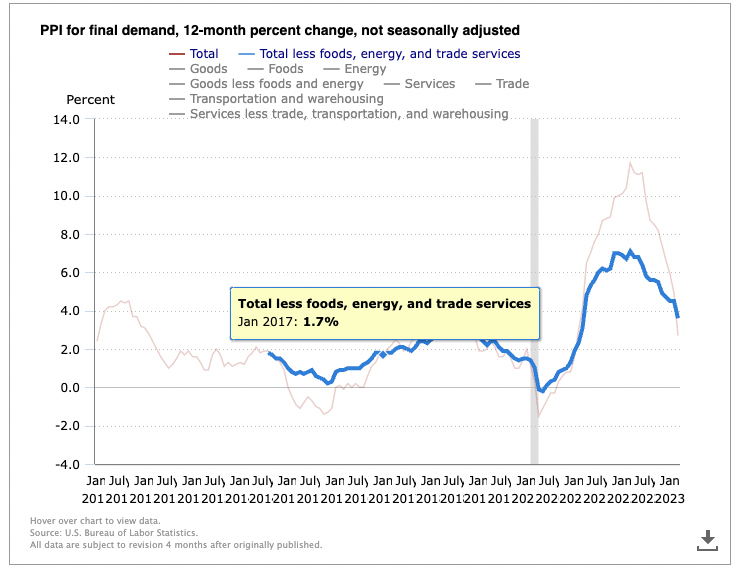

- Corporate Margins: CPI vs PPI: It ‘s not a joke that you were producing at 4% IR half year ago, and now you are borrowing at 8%, with declined demands.

Where would these all liquidities/debt come from and go to? How will Treasury and Fed plays out on this one, or yet, would they even try to play?

Still hard to believe that I am watching all of this outside of a movie theater, but I for sure will be on the sideline till the show is over, in gold.

This blog is not written by AI.

Sincerely,

Leo